Credit card debt can take a huge toll on your personal finance. Paying it off as quickly as possible will allow you to maintain your credit score and get back on track more easily. So, is applying for a personal loan a good way to go about it?

Here we’ll examine the pros and cons of using a personal loan to pay off credit card debt, so keep reading to learn more!

The advantages

1. You’ll only have to deal with one monthly payment

Debt consolidation plans can help you reduce the number of monthly payments you have to make towards your credit card debt, lowering it to just one larger payment per month. It can help you organize your time and responsibilities more efficiently.

Of course, you have to make sure you’re working with a trustworthy lender such as Credit Associates, for example. Do as much research as you can until you’ve found a debt consolidation company you can trust.

2. You can get a lower interest rate

Average credit card interest rates are around 16 percent APR, while the interest rates for personal loans average at 6 percent APR.

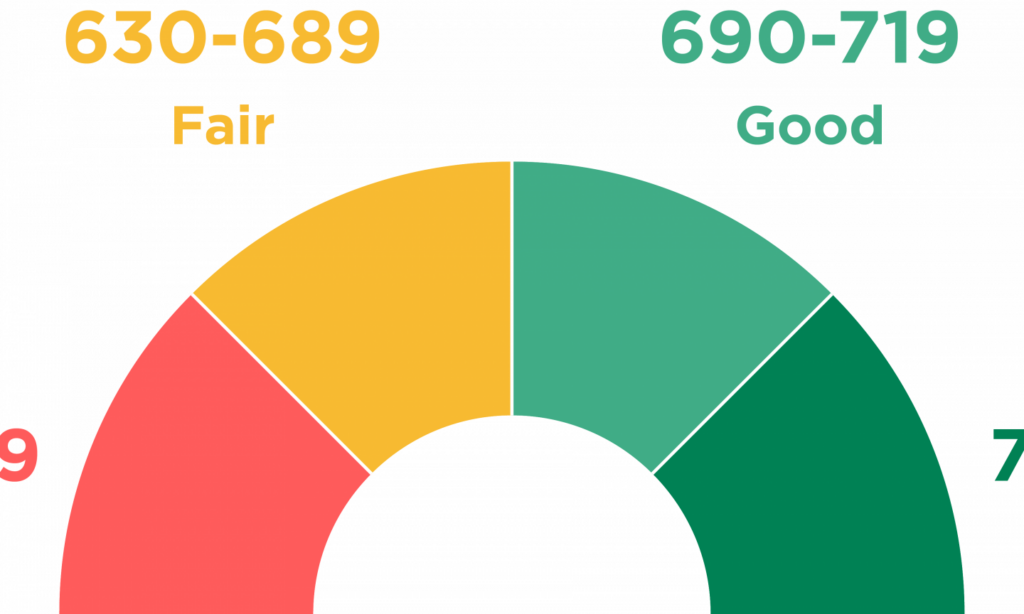

Now, of course, all of this depends on your credit score, so check up with your financial advisor to find the best possible solution.

Since you’ll be paying much lower interest rates, you may be able to pay off your debts much more quickly. Again, ensure your credit score is high enough to provide you with reasonable interest rates on personal loans before rushing into making this decision.

3. It can help you boost your credit score

Taking out a personal loan can increase your credit mix, showing potential lenders and banks you’re responsible enough with your money to keep different types of credit and debt.

Besides, you’ll be able to pay off your credit card debt much more quickly. All of that will bring your credit utilization down to 0%, in turn boosting your credit score.

Potential drawbacks

4. You won’t be debt-free afterward

Taking out a personal loan doesn’t automatically resolve your financial troubles. You’ll still have to pay back the loan after your credit card debt is settled. If you’re unsure you’ll be able to make these payments in time, you could be risking lowering your credit score. Ensure you’re not committing to something you won’t be able to handle in the future and assess your finances carefully beforehand.

5. You’ll have to pay some fees

All lenders have their own fee systems that should be considered carefully before you apply to one of their debt relief programs. These fees should be transparent and reasonable, so be wary of lenders who’re refusing to disclose this information right off the bat.

6. You’ll have to avoid using your credit cards until you’ve paid off the personal loan.

Avoiding using your credit cards until your debt is completely resolved could prove to be difficult for some people. However, if you’re taking out a personal loan to pay off your credit card debt, racking up new credit card balances could leave you worse off than you started.