Choosing the right business structure is an important decision for any new business owner. It affects a variety of aspects of your business from liability to taxes. So, you must take sufficient time to research and consider all of your options before making a final decision.

There are many factors to consider when choosing a business structure, including the size and scope of the business, and the jurisdictions in which the company will operate.

In this blog post, I’ll explain each type of business entity and some of the key considerations for choosing between them.

What Is A Business Structure

A business structure is a framework that governs how an organization will operate. It defines the roles, titles, and duties of each individual. It also details who owns what portion of the company. These things must be taken into account when setting up and maintaining the structure for a business.

Moreover, critical decisions must be made regarding ownership percentages, dividend payouts among owners, taxation obligations, and other factors specific to the chosen structure.

It’s important to note that some types of businesses may require additional permits or licenses to operate lawfully within their jurisdiction. So, it’s better to take a piece of legal advice from a professional small business attorney in Arizona.

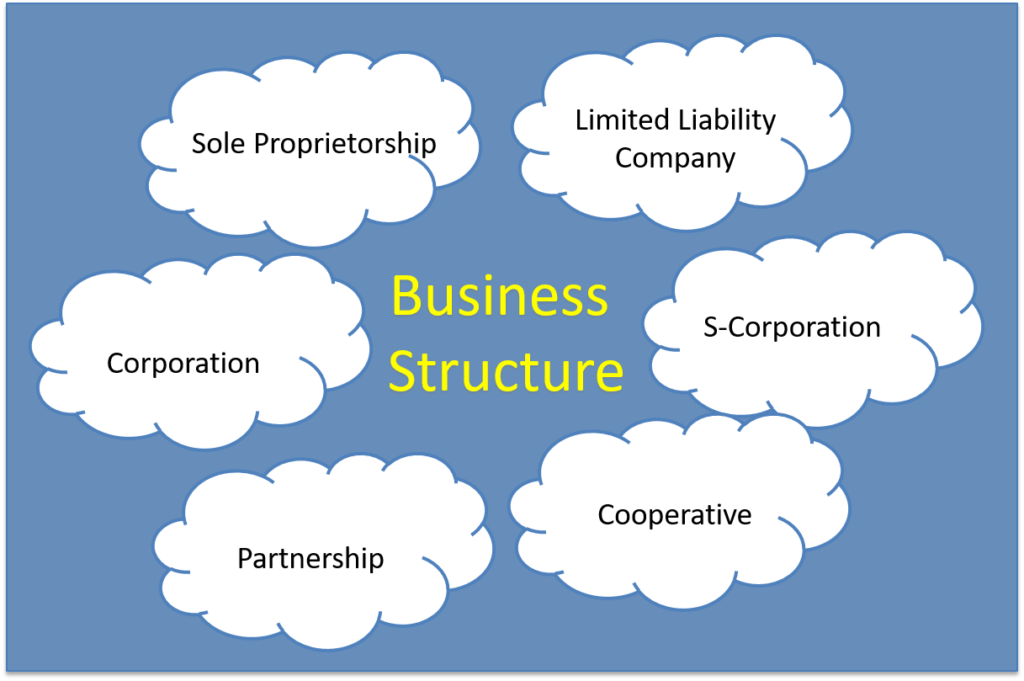

Types Of Business Structure

When starting a business, it is important to consider the type of structure that best meets your needs and goals.

1. Sole Proprietorships

Sole proprietorships are the easiest to set up and maintain, allowing for single-owner management and liability protection.

2. Partnership

There are many benefits to creating a partnership within your business instead of sole proprietorship, because it opens more room for opportunities amongst multiple partes. The two common types of partnerships are either a general partnership where everything (work & profit) is shared equally and a limited partnership in which one person controls the business operations and the other invests and receives revenues according to the partnership agreement.

3. Limited Liability Companies

Limited Liability Companies (LLC) provide strong flexibility and freedom in managing finance. Limited Liability Partnership, is a form of partnership that allows each partner to have limited liabilities, which are no higher than the amount the partner has invested into the organization.

4. Corporation

Depending on their size and scope, business owners may consider establishing a corporation that is known for tax treatment as income flows through to shareholders or opting for an S-Corporation option where all wages are subject to federal income tax.

How To Choose The Right Business Structure

Different business structures have different pros and cons, so it’s important to choose the right one for your business. Here are seven key factors to consider when choosing your business structure.

Control

Control is one of the most important factors to consider when choosing a legal business structure. Different structures offer different levels of control over decision-making processes. Which can be beneficial depending on how much control you want vs how much input from outside sources you are comfortable with.

Taxes

Tax considerations are also extremely important when choosing a business type because different types can result in different tax liabilities. For example, sole proprietorships may not be subject to corporate taxes at all. While others such as C-corporations may be subject to double taxation (once at the corporate level and again at the individual level).

Capital Investment

The amount of capital investment required for each business structure can significantly vary. A sole proprietorship requires very little capital investment but has limited growth potential. Partnerships or corporations require more capital investment but can grow faster than solo businesses.

Depending on your goals for your business, it’s important to consider how much money you are able to invest to choose the best possible structure.

Complexity

The complexity associated with each type of business structure varies immensely as well. Sole proprietorships are generally very simple entities that require minimal paperwork or legal filings. However, corporations and LLCs involve more paperwork and legal filings than most other structures due to their more complex nature.

Liability

Consider liability when selecting a business entity type because some entities provide more protection against liability than others do. For example, corporations and LLCs generally provide better protection against liability than sole proprietorships or partnerships do.

Flexibility

Another important factor to consider is flexibility, specifically, how easily you can transition from one type of business structure to another. Some structures like sole proprietorships are incredibly easy to transition out. While others like corporations or LLCs require significant paperwork and legal filings to transfer ownership or dissolve the entity entirely.

Conclusion

A business structure is key to the foundation of your company and sets the tone for how future decisions will be made. The type of business structure you choose depends on a variety of factors, including control, and capital investment. Weighing all these options can seem daunting, but is inherently necessary for the roadmap of your business.