Cryptocurrencies are a hot topic right now – everyone seems to be talking about them. But what is all the fuss about? And what’s the best way to store your cryptocurrencies?

What is Cold Storage?

Cryptocurrencies are a new and highly volatile asset class. Because of this, it is important to have a secure way to store your coins. There are a few different options for cold storage, each with its own benefits and drawbacks.

One option is to keep your coins in a physical wallet on your computer. This is the most convenient option, but it is also the most vulnerable. If your computer is hacked, your coins could be stolen. Another option is to store your coins in a digital wallet on an online service like Coinbase or Bitfinex.

This is safer than keeping them on your computer, but it is still not 100% safe. A third option is to keep your coins in cold storage (a hardware wallet, for example). These wallets are very secure, but they are not always easy to use. Escrypto is a well-known cold storage option that is easier to use than traditional hardware wallets.

The Different Types of Cold Storage

Cryptocurrencies are highly volatile and can be quite risky for investors. To minimize the risk, some people choose to store their cryptocurrency in cold storage. There are different types of cold storage that vary in terms of security and ease of use. This blog will explore the different types of cold storage and help you decide which is best for you.

Types of Cold Storage

There are three main types of cold storage: physical, digital, and paper.

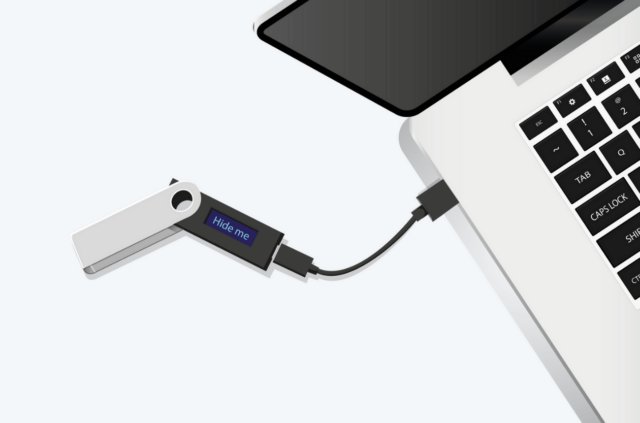

Physical cold storage is stored on a physical medium such as a hard drive or USB drive. Digital cold storage is stored on a digital medium such as an online server or a blockchain. Paper cold storage is stored on paper documents.

Each type of cold storage has its own strengths and weaknesses. For example, digital cold storage is more secure than paper cold storage, but less secure than physical cold storage. Physical cold storage is the most secure option, but it is not always easy to use. Understanding each type of cold storage will help you choose the best option for your needs.

What to Look for in a Cold Storage Provider?

If you’re more comfortable with risk, you can use a cold storage provider. This is where your coins are stored offline (usually on a cryptographic ledger). Cold storage providers are safer than hot wallets, but they’re also more expensive.

There are several different types of cold storage providers out there. You’ll need to decide which one is best for you. Some factors to consider include:

– How safe are your coins?

– How easy is it to access your coins?

– The cost of using the provider?

When it comes to securing your cryptocurrency, you need to look for a provider that has the right security measures in place. Here are four things to keep in mind when choosing a cold storage provider:

- Backup and restore procedures: Cold storage providers should have procedures in place for backing up and restoring your data. This way, you can be sure that your information is always safe.

- Security features: Make sure the cold storage provider you choose has reliable security features, such as 2-factor authentication and encryption.

- Customer support: It’s important to have someone you can turn to if you have any questions or problems with your account. Look for a provider that offers 24/7 customer support.

- Fees: Don’t forget to factor in the fees associated with using the cold storage provider. Make sure they’re reasonable and don’t add too much extra cost onto your overall investment into cryptocurrency security.

The Advantages of Cold Storage for Crypto

There are a few reasons why cold storage is a great option for storing your cryptocurrency.

– First, it’s more secure than keeping your coins on an exchange. If something were to happen to the exchange where your coins are stored, you would still have access to your coins. However, if your coins were stored in cold storage, they would be inaccessible unless you had the correct key.

– Second, cold storage is ideal for long-term storage. Cryptocurrencies are notoriously volatile and can be worth a lot or a little at any given time. Keeping your coins in cold storage means that you can avoid this volatility and keep your investment protected over time.

– Finally, cold storage is less expensive than keeping your coins on an exchange. This is because you don’t have to pay fees for transferring your coins between accounts or for using an exchange’s features like margin trading.

Disadvantages of Cold Storage for Crypto

One of the great things about cryptocurrencies is their decentralized nature. Transactions are verified by network nodes and then recorded in a public distributed ledger called a blockchain. This makes cryptocurrency transactions immune to government or financial institution interference.

However, this also means that cryptocurrency holdings are not as secure as traditional investments, such as stocks or bonds. This is because cryptocurrencies are not backed by anything physical, such as gold or silver. In fact, some people believe that cryptocurrencies are more vulnerable to theft and fraud than traditional investments.

There are several reasons why cold storage may not be the best solution for cryptocurrency holdings.

– First, it can be difficult to securely store large amounts of cryptocurrency offline.

– Second, it can be time-consuming and expensive to access your cold storage coins if you need to make a transaction.

– Third, if your computer or phone is hacked, your cryptocurrency holdings could be compromised.

If you are considering storing your cryptocurrencies in cold storage, be sure to do your research and consult with a qualified financial advisor.

Conclusion

When it comes to storing your cryptocurrency, you have a few different options available to you. The most popular option is cold storage, which refers to keeping your coins offline and tucked away in a safe location.

This is the safest way to keep your coins, as there is no risk of them being stolen or lost if someone were to break into your cold storage wallet. However, this method can be difficult to use – you’ll need to find a secure place to store your coins and make sure they’re inaccessible from outside sources.